will county illinois property tax due dates 2021

1 st Installment due June 1 2022 with the interest to begin accruing June 2 2022 at 15 per month post-mark accepted. Real Estate Tax Bills.

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

2 nd Installment due September 1 2022 with the interest to begin accruing September 2 2022 at 15 per month post-mark accepted.

. Tuesday March 2 2021 Late Payment Interest Waived through Monday May 3 2021. For instance 2019 taxes are billed and due in 2020. The measure shows the convoluted extremes that Californias tangled property tax system produces Los Angeles Times Editorial Board.

DuPage County IL Government Website with information about County Board officials Elected Officials 18th Judicial Circuit Court Information Property Tax Information and Departments for Community Services Homeland Security Public Works Stormwater DOT. Property Tax Rate Simulator Tool. The easiest and fastest way to pay your Cook County Property Tax Bill is online.

Due dates will be as follows. Henry County Treasu rer-Collector. Tuesday March 1 2022 Tax Year 2020 Second Installment Due Date.

Tax rates are provided by Avalara and updated monthly. TAX BILLS ARE NOW AVAILABLE ONLINE. AvaTax delivers real-time sales tax rates and uses advanced technology to map rates to exact address locations based on the latest jurisdiction requirements.

Starting in 2021 payment of current year mobile home property taxes will not be accepted until all prior years of unpaid taxes have paid and open liens have been properly released and recorded. Look up 2022 sales tax rates for Chicago Illinois and surrounding areas. The County Treasurer sends out approximately 6000 property tax bills each year and collects over 10000000 which is distributed to over 40 taxing districts.

1st installment - June 9 2022 2nd installment - September 9 2022. For assessment property description multiplier exemption questions and address changes contact the Supervisor of Assessments Office at 618-664-2848. The Illinois sales tax rate is currently.

The outbreak of COVID-19 caused by the coronavirus may have impacted sales tax filing due dates in Hillsborough County. Please consult your. The 2022 County Health Rankings National Findings Report examines the issues and opportunities to ensure economic security and health for all through a living wage fair pay for women affordable and accessible childcare and well-resourced equitably funded schools.

Rex Kiser County Treasurer 2021. For tax billing and payment questions contact the County Treasurers office at 618-664. Annual tax bills are mailed thirty days prior to the first due date which is customarily June 1 and the second due date is customarily September 1.

But Proposition 19 would just expand the inequities in Californias property tax system. Cook County is reassessed triennially which means one-third of the county is reassessed each year. Under Florida law e-mail addresses are public records.

Rock Island County 2021 Fiscal Year Budget Book. Residential sidewalks on your own property when they do not exceed three 3 feet in width typically dont require permits. The outbreak of COVID-19 caused by the coronavirus may have impacted sales tax filing due dates in Chicago.

The treasurers office is responsible for annual tax collections that range from 42 to 48 million for more than 40 taxing districts. Since the 2020 tax year unpaid mobile home taxes and penalties have been sent to the annual tax sale. Rock Island County Attorney Bozemans brief.

Chairman Brunks response to Landmarks Illinois. Property tax bills are mailed twice a year by the Cook. Due Dates Tax Year 2021 First Installment Due Date.

County and city sales tax rates. IF YOU USE THIS AS A TAX BILL YOU MUST ADD 200 TO YOUR PAYMENT OR IT WILL BE RETURNED. We would like to show you a description here but the site wont allow us.

Friday May 6th 2022. Friday October 1 2021 Tax Year 2020 First Installment Due Date. Important message regarding the taxes paid to Claypool Drainage District.

PLEASE VISIT THE PAGE MAKE A PROPERTY TAX PAYMENT OR SEE. 2019 2022 2025 all Cook County townships north of North Avenue not in the City of Chicago. Market Analyst Day 2020-2021.

Check the hours of your branch. Information printed from this site should not be used in lieu of a tax bill. When in doubt call the Building Division at 863 402-6643.

Gitlab Code and Models. Please consult your local tax authority for specific details. How often is my property reassessed.

Douglas County Property Tax Inquiry. During her time with Stevens County Valz has led the finance team in securing multiple county-owned bonds that have leveraged dollars to fund public projects instead of utilizing private banks which has cut. For tax rate tax levy and delinquent tax questions contact the County Clerks office at 618-664-0449.

Due dates are June 9th August 9th September 9th and November 9th. The 2021 Real Estate Tax bills will go in the mail on April 29 2022. Call the Treasurers office if you wish to see if.

NOTICE TO MOBILE HOME OWNERS. 2021 2024 2027 all City of Chicago townships North Tri. Cook Countys property tax assessment schedule through 2020 is broken into three sections.

It favors one narrow segment of the tax-paying public but does nothing for the rest of the states home buyers. If you are unable to pay online you may pay at any of the nearly 400 Chase Bank locations in Illinois including those located outside of Cook County. You must present with your payment a tax bill payment coupon either for the current Tax Year 2021 payable in 2022.

Income Tax Return Filing Deadline What Time Are Taxes Due In 2022 Marca

Pin By Keiram On We Hunt The Flame I Forgive You I Am Awesome I Was Wrong

This Is True So True True Caring

Tax Day Is Coming Soon Here S What You Need To Know About Filing Your 2021 Taxes Chicago News Wttw

Taking This Opportunity To Express Our Gratitude For Your Customer Referral To Our Business Quality Barber College We A Irs Taxes Financial Services Tax Help

![]()

Tim Brophy Will County Treasurer

Tim Brophy Will County Treasurer

Property Tax How To Calculate Local Considerations

Tim Brophy Will County Treasurer

Design Ideas Home Architecture Drawings Beauty Slodive Mississippi Long Beach Mississippi Personal Logo Design

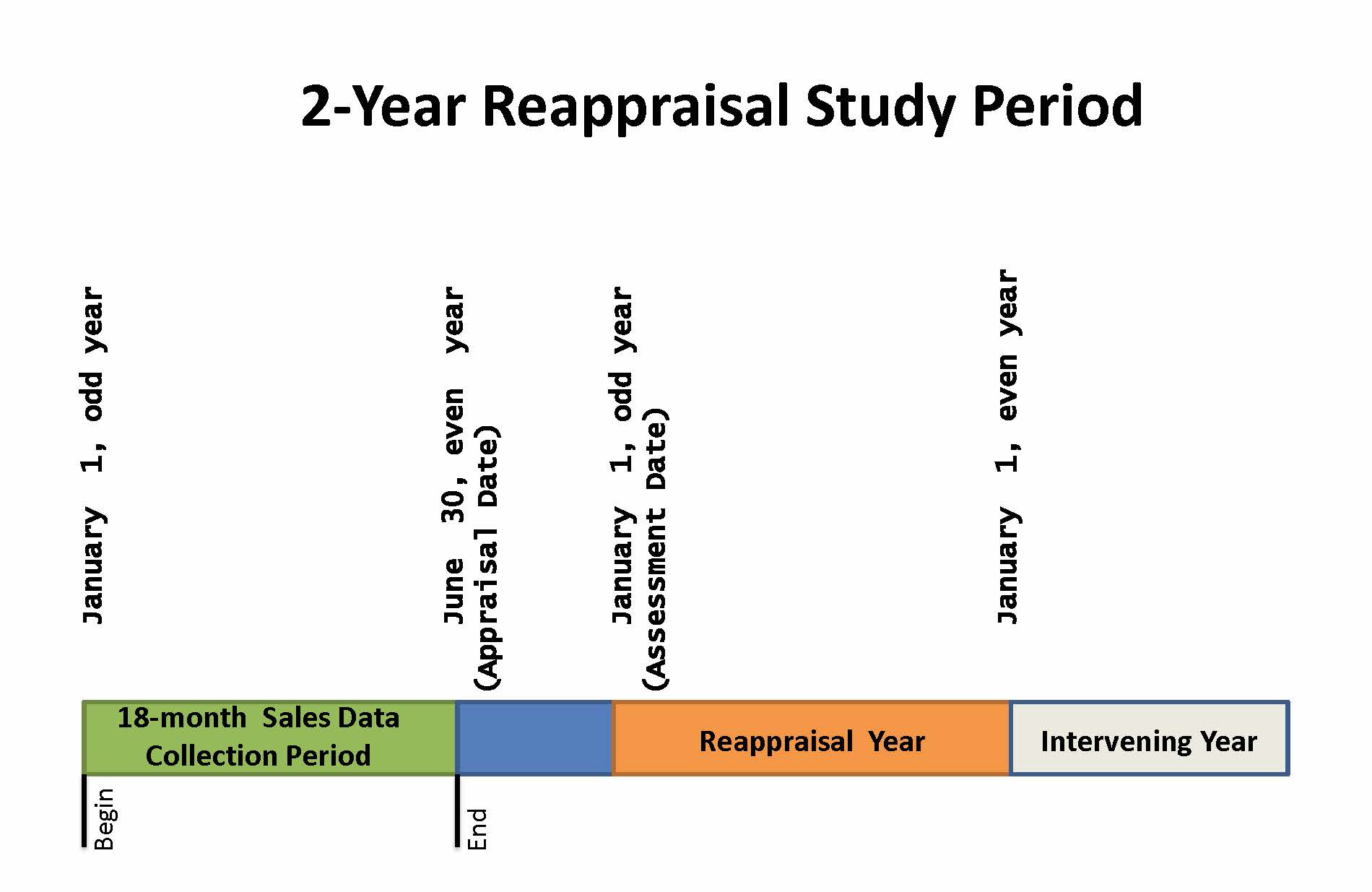

Property Assessment Process Adams County Government

Pin By Zoe Murphy On Olivia Rodrigo Drivers License Listening Streaming

Tim Brophy Will County Treasurer

Online Payment System Tim Brophy

Tim Brophy Will County Treasurer

Tim Brophy Will County Treasurer

Deducting Property Taxes H R Block

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates